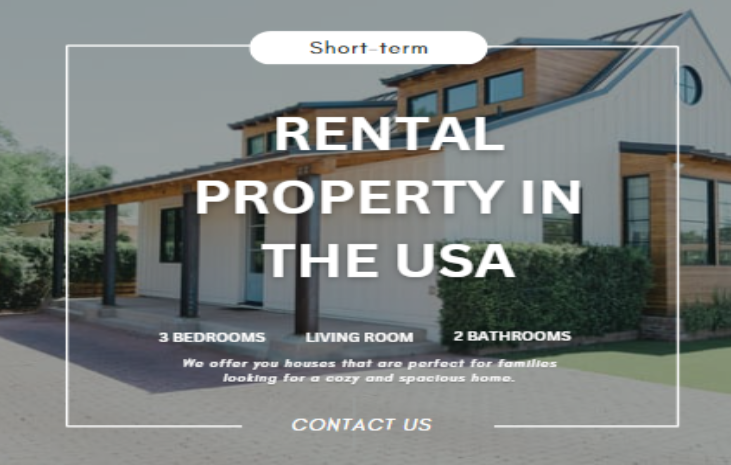

5 Reasons to Invest in a Short-Term Rental Property in the USA

Investment in short-term rental properties in the US. has been a popular option for real estate investors looking for high returns and consistent income Driven by platforms like Airbnb, Vrbo, and Booking.com the short-term rental market has grown exponentially in recent years The combination makes short-term rentals an attractive alternative Five compelling reasons to invest in short-term rentals in the US. is listed below.

1.Availability of higher premiums

One of the most attractive reasons to invest in short-term rental properties is that they can earn significantly higher rates of return compared to traditional rental properties With shorter terms cost, property owners can aggressively adjust pricing based on demand, seasonality, and local events, allowing them to maximize revenue.

Higher nightly rates

Short-term rentals generally offer significantly higher rates per night than long-term rentals. For example, a property that could cost $2,000 per month on a year-round lease could have $200 per night as a short-term rental if rented for only 15 nights a month with the property bringing in $3,000,000. a 50% increase over long-term mortgages.

Changes in pricing

With the right pricing strategy, property owners can take advantage of high-demand periods such as holidays, anniversaries, or events Tools such as dynamic pricing systems allow owners flexible prices in real time to compete for their property prices and generate high revenue during peak periods

Several sources of income

Short-term rentals also allow for the possibility of additional allowances, such as cleaning fees, early check-in or late shopping, local transportation, transportation, or experience These additional features can significantly increase your overall revenue, especially in high-demand tourist destinations.

2.Different types of investments in banks

Investing in short-term properties offers a good opportunity to diversify your investment portfolio. Real estate in general is a proven way to build wealth, but short-term rentals offer a niche niche of the market with their own unique advantages

A hedge against market volatility

Real estate investments, especially in well-located short-term rental properties, tend to be a static business in the capital markets. This makes it an attractive option for investors who want to hedge against market fluctuations. Even in times of economic downturn, people continue to travel, despite the emphasis on affordable and flexible accommodation, which may favor temporary hotels over hotels in the customary manner

smooth geographic changes

Investors will not only buy properties in their area. They can strategically select high-demand holiday destinations or strong urban tourist destinations. Whether it’s a beach house in Florida, a cottage in the Smoky Mountains, or a townhouse in New York City, you can tailor your investment based on market trends, local regulations, and your personal preferences the

3.Flexibility and control of your assets

One of the main advantages of short-term rentals is the flexibility and control they give property owners. Unlike long-term leases, where tenants sign a lease for a year or more, short-term leases allow owners to use their property whenever they want, and they make money at the times they don’t

Individual applications

Investors can use their properties for personal vacations or as second homes, and make money even if they don’t live there. For example, securing a rental in a popular area allows you to enjoy your property by renting during periods of high demand to maximize your returns

Tenancy maintenance

Unlike long-term rentals, where tenants hold properties long-term and lock landlords into lease agreements, short-term tenants can be more selective about tenants Through maintaining high standards for occupancy and guest behavior, investors can reduce the risks associated with rental properties and ensure the property remains in good condition

Easy to maintain and repair

Cleaning frequently and checking between guests means you can get on top of any necessary repairs or maintenance faster than long-term tenants. This reduces the chances of major issues arising in the long run, helping to preserve asset value and reduce long-term costs.

4.Tax benefits and deductions

Short-term rentals offer many tax advantages that can improve overall profitability and offset costs. Many property owners are unaware of the many deductions available, which can significantly impact the financial return on their investments

Reducing operating costs

Expenses associated with short-term rental services can be deducted from rental income, including property maintenance, cleaning services, marketing, utilities, insurance, and supplies costs. These discounts can significantly reduce taxable income and make the investment more financially attractive.

Benefits of depreciation

Real estate investors benefit from the depreciation of the property itself, which is a non-cash expense that reduces taxable income. Even if the property is increasing in value, you can depreciate it over some years for tax purposes, maximizing your tax savings.

pass-through interrupts

Owners of short-term rentals may also qualify for pass-through deductions under the Tax Cuts and Jobs Act (TCJA), which allows qualified investors to withdraw their funds up to 20% of qualifying employment income to significantly improve the property’s after-tax accountability.

1031 Exchange rights

Investors looking to expand or move their real estate holdings can use 1031 exchanges, a provision of the tax code that allows capital gains taxes to be deferred when they make investments hiding one property exchange for another can be a powerful option for short-term rentals without facing an immediate tax burden.

5.Growing travel and leisure facilities

The travel industry has changed dramatically in recent years, with short-term rentals becoming increasingly popular. Several trends indicate that demand for vacation rentals will continue to rise in the coming years, and now is a good time to invest.

Remote work and “Workcations”.

The rise of remote services has dramatically changed the way people travel. Many professionals now prefer extended stays in vacation rentals where they can work remotely while enjoying the new location. The concept of “workcations” has gained traction, where people mix work and leisure, driving increased demand for short-term rental properties with reliable internet, workspaces that are beautiful and easy to work with

Alternative accommodation preferred

Post-pandemic travelers are increasingly opting for private self-catering accommodation over traditional hotels. Short-term rentals offer plenty of space, privacy, and flexibility, and are popular with families, groups, and individual travelers. This trend is expected to continue, making short-term rentals a lucrative investment.

The rise of domestic travel

With unpredictable international travel restrictions and the rising cost of traveling abroad, more and more Americans are opting for domestic travel. These changes increased the demand for short-term rentals in popular areas in the US. vacations, from beach towns to mountain resorts, grew. As more people seek out local adventures, the demand for unique luxury accommodation continues to grow.

Conclusion

Investing in short-term rentals in the US. offers a range of benefits, from the potential for capital gains from rental properties to tax advantages, from liquidating savings accounts to control over your assets. The continued growth of the travel industry and the increasing popularity of vacation rental properties make this type of investment more attractive for those looking for economic return and self-service By carefully choosing a location that is appropriate and with the benefits mentioned above, investors can generate profitable and sustainable investments